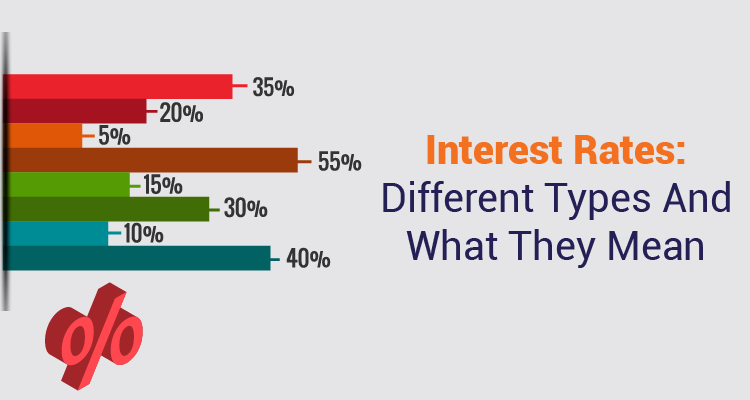

What Are the Different Types of Loan Interest Rates?

When considering any type of loan—be it a mortgage, auto loan, personal loan, or business loan—understanding the types of loan interest rates is crucial to making informed financial decisions. Interest rates directly affect your monthly payments, the total cost of borrowing, and even loan eligibility. Below, we provide a comprehensive guide to the different types … Read more